How Much House Can I Afford?

If you wonder how lenders determine how much house you can afford and would like to run your own numbers then you’re in the right place.

Believe it or not, the qualification calculations are so simple a financial calculator is not necessary; you’ll need your monthly debt, monthly income and a basic calculator – or you can run your numbers manually.

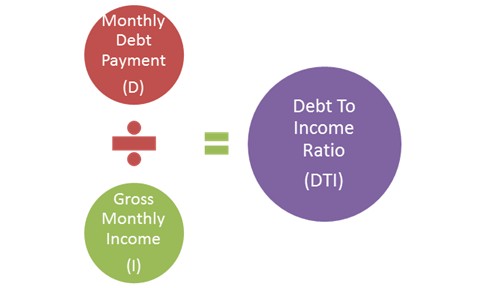

Mortgage professionals use debt-to-income (DTI) ratios to qualify you for a mortgage. This ratio takes into account all of your monthly obligations, your monthly income and the monthly payment of your new home (as you can see everything is based on monthly numbers).

To get a visual take a look at this :

First we will begin with a few mortgage terms:

Monthly Gross Income: This is your monthly income before any deductions (i.e. taxes, 401k, insurance) and includes any bonuses, commission, child support and/or alimony received.**

Monthly Debt: This is anything found on your credit report such as cars, credit cards and other loans – only the minimum payments are used. Utility bills being reported do not count as a monthly debt.**

**If you are paying child support, add the monthly child support payments to your monthly debt. If you are paying alimony, the majority of the time alimony will be added to your monthly debt; however, there are some lenders that will require alimony to be deducted from your gross monthly income. You’ll need to discuss the details with your chosen mortgage professional.

Proposed Housing Payment: This is the amortized principal and interest payment, property taxes and homeowners insurance for the house you are purchasing.

Now let’s look at the numbers:

For this example we will assume the purchase of a single family home with no mortgage insurance. The purchase price is $200,000 with a 20 percent down payment. Also, the payment calculated includes monthly taxes of $250 and homeowners insurance of $66.

Monthly Gross Income: $4,166 (this is $50,000 annually)

Monthly Debt: $650

Monthly Housing Payment: $1068

We now have all of our pertinent information, let’s do the math!

$1068 (mortgage payment) / $4166 (income) = 25%

$1068 (mortgage payment) +$650 (debt) / $4166 (income) = 41%

Your DTI is 25%/41% – these are good ratios. Ideally your back-end ratio (this is the 41%) should not exceed 43%, but there is some room as DTI limits will vary slightly from lender to lender.

You don’t want to become a slave to your mortgage so be realistic about how much you can afford and be very clear about your financial goals.

Edited By: Gerrmaioud Chape

By Selena Garcia