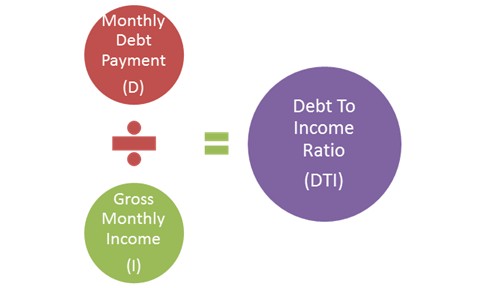

. Step 2: Figure out How Much You Can Afford You can calculate how much you can afford by starting online. There are several online mortgage calculators that will help you calculate an affordable monthly mortgage payment. My favorite is http://www.ApprovedByGerrmaioud.com as it comes in the form of a mobile App and with a direct link to a mortgage expert for advice. Remember that you don’t always have to put down 20 percent as your parents once did. There are loans available with little to no down payment. An experienced home loan expert can help you understand all your loan options, closing costs and other fees.

. Step 2: Figure out How Much You Can Afford You can calculate how much you can afford by starting online. There are several online mortgage calculators that will help you calculate an affordable monthly mortgage payment. My favorite is http://www.ApprovedByGerrmaioud.com as it comes in the form of a mobile App and with a direct link to a mortgage expert for advice. Remember that you don’t always have to put down 20 percent as your parents once did. There are loans available with little to no down payment. An experienced home loan expert can help you understand all your loan options, closing costs and other fees.  Step 3: Find the Right Lender and Real Estate Agent To find the right mortgage lender It’s best to shop around. Get recommendations from your friends and family and check with the Better Business Bureau. Talk to at least three or four mortgage lenders. Ask lots of questions and make sure they have answers that satisfy you. Make sure to find someone who you are comfortable with and who makes you feel at ease. I recommend this guy :

Step 3: Find the Right Lender and Real Estate Agent To find the right mortgage lender It’s best to shop around. Get recommendations from your friends and family and check with the Better Business Bureau. Talk to at least three or four mortgage lenders. Ask lots of questions and make sure they have answers that satisfy you. Make sure to find someone who you are comfortable with and who makes you feel at ease. I recommend this guy :  Once you have the right mortgage lender, make sure you at least get a pre-approval. Pre-qualifications are only a guess based on what you tell the lender and are no guarantee, whereas a pre-approval will give you a better idea of how big a loan you qualify for. The lender will actually pull your credit and get more information about you. However, you could even take it one step further by getting an actual approval before you start home shopping. That way, when you’re ready to make an offer, it will make the sale go much quicker. Besides, your offer will look more appealing than other buyers since your financing is guaranteed. In fact some lenders are capable of getting you a Loan commitment even before you find a property. Step 4: Look for the Right Home Make a list of the things you’ll need to have in the house. Ask yourself how many bedrooms and bathrooms you’ll need and get an idea of how much space you desire. How big do you want the kitchen to be? Do you need lots of closets and cabinet space? Do you need a big yard for your kids and/or pets to play in? Once you’ve made a list of your must-have’s, don’t forget to think about the kind of neighborhood you want, types of schools in the area, the length of your commute to and from work, and the convenience of local shopping. Take into account your safety concerns as well as how good the rate of home appreciation is in the area.

Once you have the right mortgage lender, make sure you at least get a pre-approval. Pre-qualifications are only a guess based on what you tell the lender and are no guarantee, whereas a pre-approval will give you a better idea of how big a loan you qualify for. The lender will actually pull your credit and get more information about you. However, you could even take it one step further by getting an actual approval before you start home shopping. That way, when you’re ready to make an offer, it will make the sale go much quicker. Besides, your offer will look more appealing than other buyers since your financing is guaranteed. In fact some lenders are capable of getting you a Loan commitment even before you find a property. Step 4: Look for the Right Home Make a list of the things you’ll need to have in the house. Ask yourself how many bedrooms and bathrooms you’ll need and get an idea of how much space you desire. How big do you want the kitchen to be? Do you need lots of closets and cabinet space? Do you need a big yard for your kids and/or pets to play in? Once you’ve made a list of your must-have’s, don’t forget to think about the kind of neighborhood you want, types of schools in the area, the length of your commute to and from work, and the convenience of local shopping. Take into account your safety concerns as well as how good the rate of home appreciation is in the area.  Step 5: Make an Offer on the Home Now that you’ve found the home you want, you have to make an offer. Most sellers price their homes a bit high, expecting that there will be some haggling involved. You can get a list from your real estate agent to find out how much comparable homes have sold for. Once you’ve made your offer, don’t think it’s final. The seller may make a counter-offer to which you can also counter-offer. Once you’ve agreed on a price, you’ll make an earnest money deposit, which is money that goes in escrow to give the seller a sign of good faith.

Step 5: Make an Offer on the Home Now that you’ve found the home you want, you have to make an offer. Most sellers price their homes a bit high, expecting that there will be some haggling involved. You can get a list from your real estate agent to find out how much comparable homes have sold for. Once you’ve made your offer, don’t think it’s final. The seller may make a counter-offer to which you can also counter-offer. Once you’ve agreed on a price, you’ll make an earnest money deposit, which is money that goes in escrow to give the seller a sign of good faith.  Step 6: Get the Right Mortgage for Your Situation There are many different types of mortgage programs out there, but as a first-time home buyer, you should be aware of the three basics: adjustable rate, fixed rate and interest-only.

Step 6: Get the Right Mortgage for Your Situation There are many different types of mortgage programs out there, but as a first-time home buyer, you should be aware of the three basics: adjustable rate, fixed rate and interest-only.

- Adjustable rate mortgages (ARMs) are short-term mortgages that offer an interest rate that is fixed for a short period of time, usually between one to seven years. After that, the interest rate can adjust every year up or down, depending on the market. These are good for people who don’t plan on living in their home very long and/or are looking for a lower interest rate and payment.

- Fixed-rate mortgages are more traditional and offer a fixed interest rate (and thus a fixed monthly payment) for a longer period of time, usually 15 or 30 years, though they’re available in 20 or 25 year terms. These are good for people who like a predictable payment and plan on living in their home for a long time.

- Both fixed and adjustable rate mortgages can have an interest-only payment. What this means is that for a certain amount of time during the loan term, you’re allowed to pay only enough to cover the interest portion of your payment. You can still pay principal when you wish, but don’t have to if your budget is tight. There is a myth that with interest-only mortgages, you don’t build equity. This is not necessarily true, since you can build equity through home appreciation. The benefit to interest-only mortgages is that you increase your cash flow by not paying principal.

Remember to ask your mortgage lender or mortgage banker lots of questions about which mortgage is right for you and your situation.  Step 7: Close on Your Home Make sure you get a home inspection before you close. It will be well-worth the money spent since it ensures the property’s structural soundness and good condition. Setting the closing date that is convenient to both parties may be tricky, but can certainly be done. Remember that you may have to wait until your rental agreement runs out and the seller may have to wait until they close on their new house. Be sure you talk to your mortgage banker to understand all the costs that will be involved with the closing so there are no surprises. Closing costs will likely include (but are not limited to) your down payment, title fees, appraisal fees, attorney fees, inspection fees, and points you may have bought to buy down your interest rate.

Step 7: Close on Your Home Make sure you get a home inspection before you close. It will be well-worth the money spent since it ensures the property’s structural soundness and good condition. Setting the closing date that is convenient to both parties may be tricky, but can certainly be done. Remember that you may have to wait until your rental agreement runs out and the seller may have to wait until they close on their new house. Be sure you talk to your mortgage banker to understand all the costs that will be involved with the closing so there are no surprises. Closing costs will likely include (but are not limited to) your down payment, title fees, appraisal fees, attorney fees, inspection fees, and points you may have bought to buy down your interest rate.

You’ve got your mortgage, closed the deal and now it’s time to move in! Whether you use a mover or not is up to you, depending on your financial situation and how much stuff you have to move; perhaps also, whether you have a lot of friends willing to help you move. Either way, you’re done with the home buying process! Just start unpacking and start enjoying your first home! Buying a home for the first time doesn’t have to be a hassle if you’re prepared and you know what to do and when to do it. Choose an experienced home loan lender and a friendly, knowledgeable real estate agent-they are the key to helping you have a smooth home buying experience!

Edit By Gerrmaioud Chape Original By Diane Tuman

Edit By Gerrmaioud Chape Original By Diane Tuman